Same admissions process for all three tracks. So, you choose which track works best for you.

Not sure which is right for you? Here’s student profile examples to help you decide:

Traditional | Traditional | Accelerated |

|---|---|---|

|

|

|

*While all MSF students have access to the concierge-level support provided by the MSF Office of Career Management, students who enroll in the MSF Career Strategy course receive additional support through a formal academic course.

View to read the infographic transcript.

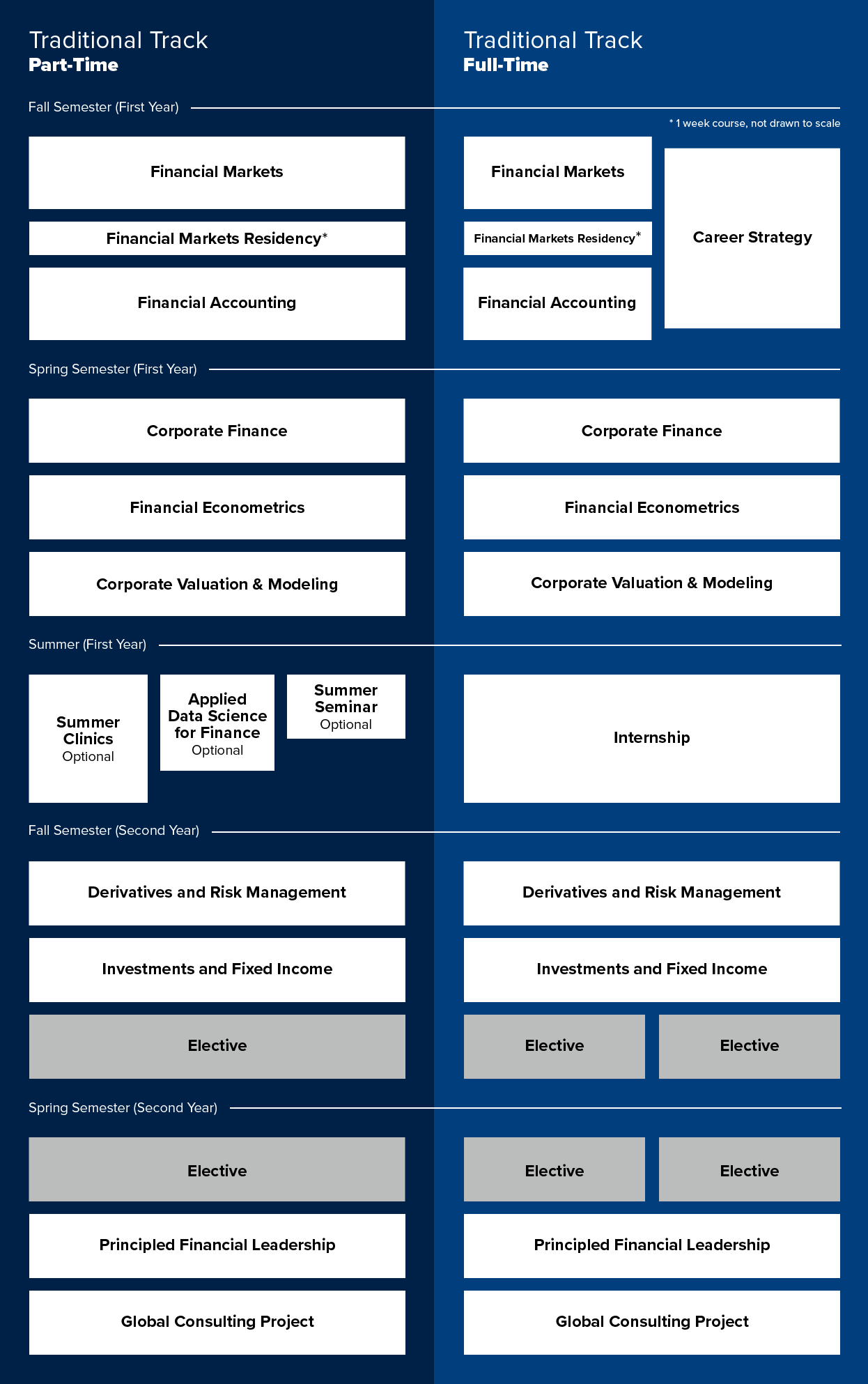

For the traditional part-time track, your course sequence is as-follows: You will be taking Financial Markets, Financial Markets Residency and Financial Accounting in the Fall semester of your first year. Then, Corporate Finance, Financial Economics and Corporate Valuation and Modeling in the Spring semester of your first year. In the Summer of your first year, you have 3 optional courses - Summer clinics, Applied Data Science for Finance and Summer Seminar. Moving into the Fall semester of your second year, you will be taking Derivatives and Risk Management, Investments and Fixed Income and an elective course of your choice. And, finally, in the Spring semester of your second year, you will take an elective of your choice, Principled Financial Leadership and the Global Consulting Project.

For the Traditional Track Full-Time option, you will be taking 4 courses in the Fall semester of your first year instead of 3 courses. You will be taking Financial Markets then Financial Markets Residency and then Financial Accounting and Career Strategy, which will overlap with the other 3 courses. Then, Corporate Finance, Financial Economics and Corporate Valuation and Modeling in the Spring semester of your first year. In the Summer of your first year, you will be taking your internship. Moving into the Fall semester of your second year, you will be taking Derivatives and Risk Management, Investments and Fixed Income and two elective courses of your choice at the same time. And, finally, in the Spring semester of your second year, you will take two electives of your choice at the same time, then Principled Financial Leadership and the Global Consulting Project.

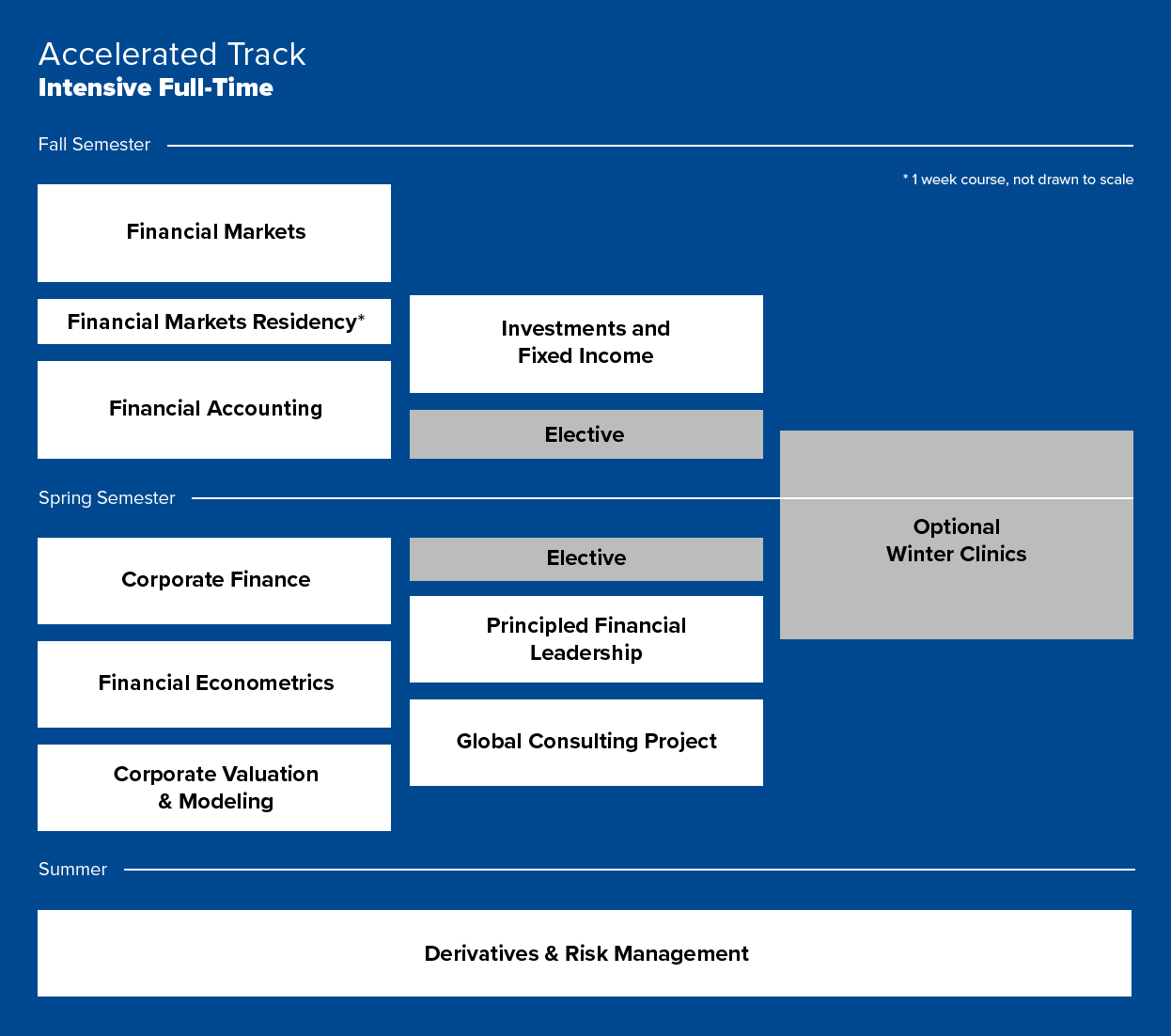

The final track option is the Accelerated Intensive Full-time. In the Fall semester of your first year, you will be taking Financial Markets then Financial Markets Residency and then Financial Accounting. Overlapping with those courses will be two additional courses - Investments and Fixed Income and an elective of your choice. That's 5 total courses. In the Spring semester of your first year, you will take Corporate Finance then Financial Economics then Corporate Valuation and Modeling. Overlapping with those courses you will be taking an elective of your choice, Principled Financial Leadership and the Global consulting project. That is 6 courses total. Between the Fall and Spring semester, you also have the option to take the winter clinics, but not required. Lastly, in the summer and final semester of this track, you will take 1 course - Derivatives and Risk Management to finish out the program. These are the 3 tracks and course breakdowns of Georgetown's blended online Master of Science in Finance program.

For the Traditional Track Full-Time option, you will be taking 4 courses in the Fall semester of your first year instead of 3 courses. You will be taking Financial Markets then Financial Markets Residency and then Financial Accounting and Career Strategy, which will overlap with the other 3 courses. Then, Corporate Finance, Financial Economics and Corporate Valuation and Modeling in the Spring semester of your first year. In the Summer of your first year, you will be taking your internship. Moving into the Fall semester of your second year, you will be taking Derivatives and Risk Management, Investments and Fixed Income and two elective courses of your choice at the same time. And, finally, in the Spring semester of your second year, you will take two electives of your choice at the same time, then Principled Financial Leadership and the Global Consulting Project.

The final track option is the Accelerated Intensive Full-time. In the Fall semester of your first year, you will be taking Financial Markets then Financial Markets Residency and then Financial Accounting. Overlapping with those courses will be two additional courses - Investments and Fixed Income and an elective of your choice. That's 5 total courses. In the Spring semester of your first year, you will take Corporate Finance then Financial Economics then Corporate Valuation and Modeling. Overlapping with those courses you will be taking an elective of your choice, Principled Financial Leadership and the Global consulting project. That is 6 courses total. Between the Fall and Spring semester, you also have the option to take the winter clinics, but not required. Lastly, in the summer and final semester of this track, you will take 1 course - Derivatives and Risk Management to finish out the program. These are the 3 tracks and course breakdowns of Georgetown's blended online Master of Science in Finance program.

Click here for a downloadable curriculum.

The three tracks include the same qualities that make the Georgetown MSF a highly sought-after degree for individuals seeking to begin or enhance their career:

- Blended learning, with asynchronous lectures and weekly live classes in our revolutionary Blended Classroom, which gives you the option to attend class in person or online and receive the same educational experience

- Cohort format, allowing students to build their professional network -- and lifelong connections -- with classmates. Cohorts will include a mix of traditional part-time and full-time students and those on the accelerated track.

- Excellence in teaching, drawing from many of Georgetown’s top professors.

- Global Consulting Project, a required course that tasks students with consulting projects for organizations abroad and then students travel to deliver final recommendations in person to the company’s leadership.

- Dedicated career services, with our MSF Center for Career Strategy and Professional Development ready to position our students for promotions, jobs within their current industry, or for a career pivot.